placer county sales tax 2020

Sales and use taxes in California state and local are collected by the California Department of Tax and Fee Administration whereas income and franchise taxes are collected by the Franchise Tax Board. Falls Church city collects the highest property tax in Virginia levying an average of 600500 094 of median home value yearly in property taxes while Buchanan County has the lowest property tax in the state collecting an average tax of 28400.

2851 Plan Ladera Ranch Sun Valley Nevada D R Horton Ladera Ranch Ladera Sun Valley

Harris County has one of the highest median property taxes in the United States and is ranked 152nd of the 3143 counties in order of median property taxes.

. The California Department of Revenue is responsible for publishing the. The exact property tax levied depends on the county in Virginia the property is located in. The median property tax in Harris County Texas is 3040 per year for a home worth the median value of 131700.

At 725 California has the highest minimum statewide sales tax rate in the United States which can total up to 1075 with local sales taxes included. Harris County collects on average 231 of a propertys assessed fair market value as property tax. The California State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 California State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

15 Sophisticated And Classy Mediterranean House Designs Home Design Lover Mediterranean Exterior Mediterranean Exterior Design Mediterranean House Designs

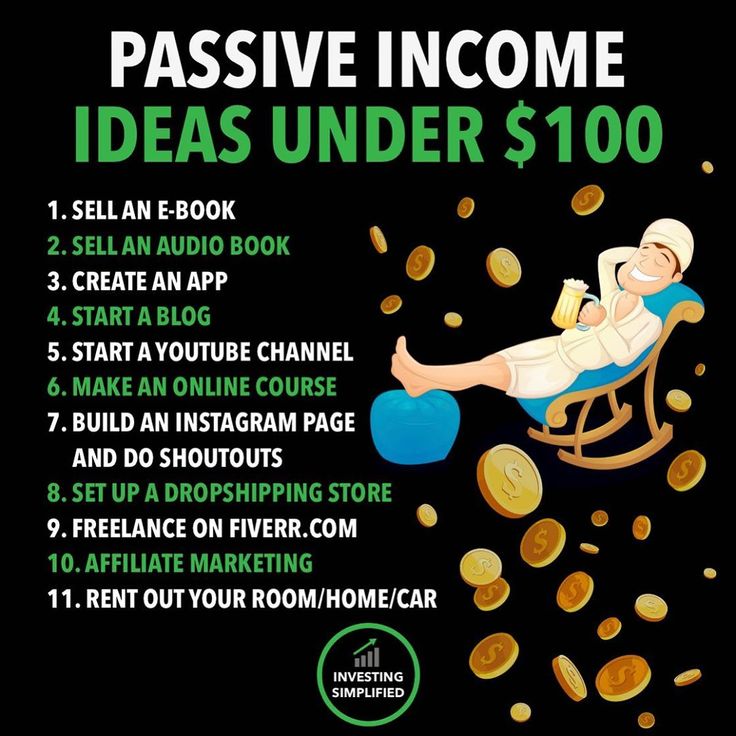

Who Loves Passive Income Passiveincome I Help Local Businesses And E Commerce To Generate Reve Start Online Business Personal Finance Budget Business Money